Sydney Sweeney, American Eagle, and the New Rules of Brand Switching in 2026

How attention cycles are reshaping trial, expectations, and retention.

NEW YORK, NY, UNITED STATES, January 20, 2026 /EINPresswire.com/ -- Backlash used to be easy to interpret. A campaign triggers criticism. The internet piles on. Brands assume damage is inevitable. But in 2026, that instinct is increasingly wrong. Because outrage isn’t the outcome. Switching is. When American Eagle faced criticism tied to the Sydney Sweeney campaign in late July 2025, the public story quickly became: this will hurt the brand. So we looked at what customers actually did.Clootrack analyzed 55,287 Voice of the Customer conversations across major apparel brands to track switching signals before and after the moment. The data told a more surprising story: The controversy didn’t push shoppers away. It pulled them in. The backlash concentrated the demand.

We tracked switching in two windows:

- Before: Jan 1, 2025 → Jul 22, 2025.

- After: Jul 23, 2025 → Sep 30, 2025.

Before the moment, the switching signal was healthy but modest: 10% influx vs 2% outflux.

After, something dramatic happened:

- Influx jumped to 41%.

- Outflux stayed flat at 2%.

That’s not a sentiment spike. That’s shoppers trying a brand - at scale. And you can hear it in how customers described it in their own words:

- “Sydney make him do it!. Husband has never tried AE jeans but… These jeans fit better than any brand he has ever purchased.”

- “With all the controversy surrounding your jeans I decided to… like the stretch of the jeans, they fit well and are comfortable.”

- “Love these jeans. I needed new jeans and wanted to give Amer… support. It was a great decision as the jeans fit and look great.”

These aren’t written by long-time loyalists. They read like first-time trials - triggered by a cultural moment. That’s the first rule of brand switching in 2026: A controversy doesn’t only create critics. It also creates shoppers.

Here's how the buying logic changed overnight:

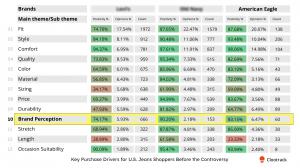

In apparel, the shopping playbook is supposed to be simple: Fit. Price. Quality. Repeat. But when a brand becomes the center of a public moment, shoppers stop comparing products like spreadsheets. They start buying with identity. Momentum. Conversation. In our VoC analysis, “Brand Perception” climbed from the 10th most discussed theme to the 8th, jumping ahead of basics like Price and Durability. That’s not a minor reshuffle. That’s what brand switching looks like when customers aren’t just buying jeans. They’re buying a stance.

The moment brings the trial wave. The trial wave brings the truth. However, attention creates volume and ultimately, volume tests everything. For example, before the wave, feedback was strong on the fundamentals:

Before (positive %)

- Fit: 88%

- Style: 93%

- Comfort: 98%

- Quality: 83%

- Color: 83%

- Sizing: 59%

But, after the wave, the product got stress-tested in public:

After (positive %)

- Fit: 85%

- Style: 90%

- Comfort: 98%

- Quality: 93% (improved sharply)

- Color: 71%

- Sizing: 46%

The biggest story isn’t the dip. It’s what the dip reveals. When a brand suddenly attracts a new audience, the experience gets evaluated at a higher scale - and with less patience. Small friction points become visible faster. In this case, post-period comments consistently pointed to two operational themes:

- Color expectations rose faster than color variety on shelf.

- Sizing consistency became harder to predict at scale.

Not a collapse. Just a pressure test. That’s the second rule of brand switching in 2026: A demand surge doesn’t just scale your upside. It prompts you to evolve faster.

Here's the new switching funnel in 2026:

The category is moving from slow switching to fast switching. The real funnel now looks like this: Attention spike → Trial wave → Product reality check → Retention or returns. A public moment can force attention. But only execution converts attention into lasting outcomes. Because in 2026, growth isn’t only won through storytelling. It’s won through readiness.

The internet will always be loud. The commentary will always be polarized. But customers settle the debate quietly: with what they buy. What they keep. And what they return. In this case, “backlash” didn’t weaken consideration. It concentrated it. And the brands that win in 2026 won’t be the ones who avoid moments. They’ll be the ones who create moments and convert them into repeat behavior - before the moment fades.

Methodology (Summary)

Clootrack analyzed 55,287 anonymized Voice of the Customer conversations across major U.S. apparel brands in two time windows: Jan 1 - Jul 22, 2025, and Jul 23 - Sep 30, 2025. “Switching” reflects explicit customer mentions of trial or movement between brands. Percentages shown are directional signals from consumer conversation data, not audited market share.

This article is an independent analysis based on publicly available customer feedback and does not imply endorsement by or affiliation with American Eagle or Sydney Sweeney.

VoC Research

Clootrack

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.